A quick look at some news.

First,

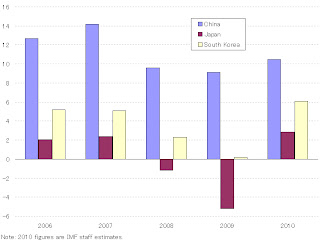

South Korea's GDP grew by 0.7% in the third quarter, short of market forecasts due to export slump, which would signal for the coming slowdown in the world economy. Asia's fourth largest economy is heavily dependent on external demand. In that sense, South Korea might want to take part in the circle of "a canary in a coal mine" along with Japan.

South Korea's economy slowed in the third quarter as export gains and global growth cooled, signaling more room to pause interest-rate increases and paring a recent surge in the nation's currency.

Gross domestic product advanced 0.7 percent from the previous three months, when it gained 1.4 percent, the central bank said in Seoul today. That was less than the 0.8 percent median forecast in a Bloomberg News survey of 10 economists. From a year earlier, GDP rose 4.5 percent.

The won's 7.2 percent third-quarter climb against the dollar was Asia's highest, adding to threats to exports from elevated U.S. unemployment and European austerity. The currency fell as much as 1.5 percent after today's data, curbing an advance that may damp accelerating inflation and give the Bank of Korea more scope to slow increases in borrowing costs.

Greece's Finance Minister George Papaconstantinou said the country's budget deficit topped 15% of GDP in 2009, which is about 1 percentage point more than previously estimated.

A review of Greece's 2009 budget showed the deficit was above 15 percent of gross domestic product, more than previously estimated, Finance Minister George Papaconstantinou said.

The revision won't affect Greece's drive to cut the shortfall this year, Papaconstantinou said at a conference in Limassol, Cyprus, today. "We are on track for the fiscal target for 2010," he said. The finance minister's budget, released Oct. 4, forecast the 2010 deficit at 7.8 percent of GDP.

"After the final revision by Eurostat to the numbers, which will validate numbers for 2009 once and for all, it will be above 15 percent," Papaconstantinou said. "Last year was a finance minister's nightmare."

Greece had to obtain 110 billion euros ($152 billion) of emergency loans from the European Union and International Monetary Fund in May as borrowing costs soared amid concerns the country wouldn't be able to reduce its budget shortfall. The revision would mean Greece overtaking Ireland as the EU country with the biggest deficit as a percentage of GDP last year. Papaconstantinou estimated the 2009 shortfall at 13.8 percent in his budget.

Eurostat, the EU's statistics service, will release the final figures for Greece's 2009 deficit and debt by Nov. 15.

Banks 'Normalizing'

Papaconstantinou said "things were normalizing" in the Greek economy, with the banking industry, which was "almost completely" reliant on European Central Bank financing, "now standing on its feet."

Greek banks' reliance on ECB liquidity to refinance operations declined in September for a second month, according to the Athens-based central bank. Lenders had a total of 94.3 billion euros compared with 95.9 billion euros in August.

The banks were locked out of markets by concerns about their holdings of Greek government bonds amid fears of a sovereign default.

The Greek government is also seeing a response to the "fast-track" process it's implementing to draw investment, especially from Chinese businesses and China's "clear commitment" to make Greece a hub, Papaconstantinou said.

Chinese Prime Minster Wen Jiabao committed to buy Greek bonds and support the shipping industry as the country sought investment to boost growth and emerge from its second year of recession.

The Greek economy is forecast to shrink 4 percent this year and 2.6 percent next year before returning to growth in 2012, according to the draft budget.

... while

Spain is trimming its budget deficit faster than its peers.

Spain is cutting its deficit faster than Ireland, Portugal or Greece, seeking to reassure investors that the nation deserves cheaper borrowing costs than its peers.

Spain's central government trimmed the deficit by 42 percent in the first nine months, compared with 31 percent in Greece and a widening budget gap in Portugal. The figures were released yesterday as budget talks broke down in Portugal, and Greece said its shortfall was bigger than reported, pushing up the yield premium investors demand to hold sovereign debt of the so-called euro peripherals over comparable German bunds.

Portuguese 10-year bond yields rose 27 basis points to 5.96 percent, the biggest one-day advance in more than a month. Greece's yield jumped 73 basis points and Ireland added 32. Spain's yield gained 9 basis points, leaving the spread over bunds near a 10-week low, reached the previous day.

Spain would be happier to say, "Bye-bye, PIIG guys. No more 'S' in the term!"

Labels: Asia, Europe