It's the fundamentals, stupid!

Usually, Japanese politicians are polite enough not to hurl criticism especially against its Asian neighbors. But this time looks like different. Japan's Prime Minster Naoto Kan said yesterday that China and South Korea should stop currency intervention.

In the meantime, Reuters saw differently on the G7 and G20 meeting, saying "Japan escapes G7, G20 criticism on yen intervention."

Japan's currency increased its value by nearly 5% in real terms this year, while China's currency appreciated just 3%. South Korea has seen mere 0.06% rise in its currency value so far.

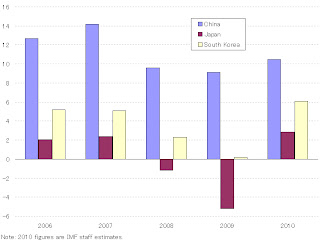

On the other hand, the GDP growth rate of China, Japan, and South Korea is estimated to be 11.2%, 0.2%, and 3.8%, respectively, on average over 5 years. It's absolutely clear that the current exchange rates are not in harmony with fundamentals. Which country should have the most valued currency among the three from the point of fundamentals? What matters now is not whether currency intervention itself should be acceptable in principle, but the underlying exchange rates are weaning themselves off the fundamental values.

Prime Minister Naoto Kan urged South Korea to stop preventing its exchange rate from appreciating and said competition with Japan's rival in the technology and automobile industries is becoming a major issue.

"In many ways, competition is a significant topic for Japan's relations" with South Korea, Kan said in parliament in Tokyo today. "Guiding one's currency lower is against the overall coordination process. We'd like South Korea and China to take responsible actions according to the common rules."

The comments underscore the government's frustration with Asian nations devaluing their currencies to protect local exporters. Japan's own intervention in currency markets for the first time in six years last month to tame the yen's advance to a 15-year high against the dollar brought about criticism from policymakers in Europe and politicians in the U.S.His words are still well-mannered and controlled, but it wouldn't be much difficult to see irritation over the seemingly never-ending rise of the yen under his callous face.

In the meantime, Reuters saw differently on the G7 and G20 meeting, saying "Japan escapes G7, G20 criticism on yen intervention."

Japan escaped overt criticism from its G7 and G20 counterparts over the weekend for its yen-selling intervention as policymakers focused on broader solutions to tackle currency misalignments.

But Tokyo has little to cheer as global tension over currency valuations raises the bar for Tokyo to intervene again to weaken the yen even after hitting a fresh 15-year high against the dollar on Friday.

Still, the silence from world finance officials on last-month's market foray could keep traders wary of pushing the yen much higher out of fear fresh intervention could follow.

…

Indeed, U.S. and European policymakers gathering for the IMF meetings, and even emerging economy delegates, barely commented on Tokyo's intervention in public, although the International Monetary Fund did offer a mild rebuke.If any intervention in currency markets isn't permitted at all, then, Prime Minister Kan's remarks would be utterly nonsense because Japan did intervene in currency markets last month. But as is seen from a graph I posted yesterday, the problem here is that the current exchange rates in three Asian nations, namely Japan, China, and South Korea, are far from fundamentals.

Japan's currency increased its value by nearly 5% in real terms this year, while China's currency appreciated just 3%. South Korea has seen mere 0.06% rise in its currency value so far.

On the other hand, the GDP growth rate of China, Japan, and South Korea is estimated to be 11.2%, 0.2%, and 3.8%, respectively, on average over 5 years. It's absolutely clear that the current exchange rates are not in harmony with fundamentals. Which country should have the most valued currency among the three from the point of fundamentals? What matters now is not whether currency intervention itself should be acceptable in principle, but the underlying exchange rates are weaning themselves off the fundamental values.

Labels: Japan

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home